A Guide for Foreigners: Buying Property on Al Marjan Island

Buying Property on Al Marjan Island: A Complete Investor’s Guide

Introduction

Al Marjan Island is not just another waterfront development—it represents a visionary investment opportunity in one of the UAE’s fastest-growing real estate markets. While regulations such as escrow accounts, title registration, and residence visa programs apply across the UAE, Al Marjan Island offers a unique blend of premium design, strong investment potential, and long-term growth opportunities.

This guide provides everything foreign investors need to know when buying property on Al Marjan Island, including ownership rights, secure payment structures, residence visas, and closing costs.

1. Freehold Ownership: True, Unencumbered Property Rights

A key advantage for foreign investors on Al Marjan Island is 100% freehold ownership. Unlike leasehold arrangements, freehold means you own the property outright with no time restrictions.

- Long-term security – Full ownership builds lasting equity and ensures your asset remains yours indefinitely.

- Investment stability – Freehold properties tend to appreciate in value and offer higher resale potential.

- Transparency – All transactions are legally documented, ensuring full buyer protection.

With a growing tourism sector and major infrastructure investments, buying property on Al Marjan Island presents a rare opportunity for foreign investors to own a piece of the UAE’s evolving real estate landscape.

2. Secure Transactions: The Escrow System

To protect investors, off-plan property purchases in the UAE—including Al Marjan Island—are regulated through a strict escrow system:

- Fund Management: Buyer payments are held in a regulated escrow account managed by an independent third party.

- Milestone-Based Releases: Payments are only released as construction progresses, ensuring that funds are used solely for project development.

- Retention Clause: Upon project handover, 10% of the total purchase price remains in escrow for 12 months as a guarantee of quality and workmanship.

This system ensures transparency and investor protection, minimizing risks and ensuring that projects are delivered as promised.

3. Flexible Payment Plans & Mortgage Options

Al Marjan Island properties are made more accessible through developer-backed payment plans and mortgage financing:

- Off-Plan Payment Plans: Buyers can take advantage of staggered payments tied to construction milestones, reducing upfront costs.

- Mortgage Financing: Local banks provide mortgages for eligible foreign investors, with financing covering up to 50% of the property value.

- Investment Efficiency: These financing options allow investors to enter the market with manageable capital allocation while benefiting from long-term property appreciation.

4. Cost of Purchase: Closing Costs and Fees

When buying property on Al Marjan Island, buyers should budget for the following closing costs:

- Property Registration Fee: 4% of the property value.

- Mortgage Registration Fee: 2% of the loan amount (if financing is used).

- Administration Fees: Approximately AED 5,000.

- Power of Attorney (POA) Fees: If applicable, for buyers using a legal representative.

- Registration Trustee Fees: Approximately AED 4,200, covering the official property transfer process.

These costs should be factored into your total investment budget to ensure a clear financial picture before purchasing.

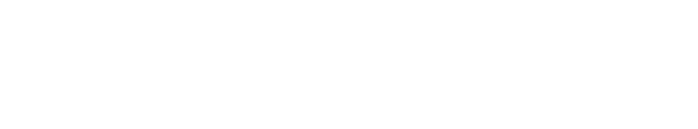

5. Residence Visas: Property Investor Options

Buying property on Al Marjan Island can qualify buyers for a renewable UAE residence visa, with multiple categories based on investment value:

- AED750K+ Investment → 2-year renewable visa

- AED1M+ Investment → 5-year renewable visa

- AED2M+ Investment → 10-year Golden Visa

Key Benefits of All Residence Visas:

✔️ Ability to sponsor family members (spouse & children)

✔️ Open local bank accounts & access financial services

✔️ Apply for a UAE driving license

✔️ Access healthcare, utilities, and essential services

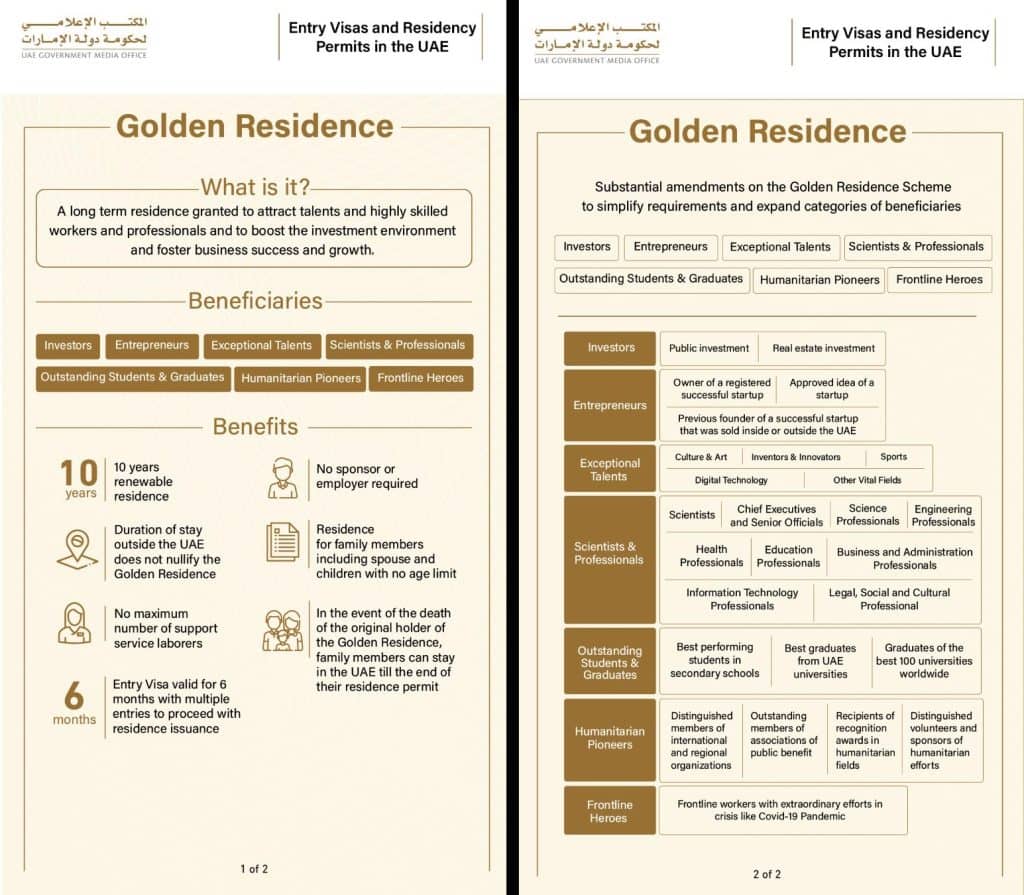

Golden Visa: Is It Worth It?

The Golden Visa (10 years) is ideal for investors with AED2M+ in real estate assets. While it provides the same benefits as standard residence visas, it offers:

✅ Longer validity (10 years) with no need for renewals every 3–5 years

✅ More business flexibility – easier company setup and ownership rights

✅ No local sponsor required

For investors looking for long-term residency stability with minimal renewal processes, the Golden Visa is the best option.

6. Proof of Purchase: Title Deeds and Pre-Titles

Securing the right legal documentation ensures your investment is fully protected:

- Title Deeds (Oqood & Final Title): Once construction is complete, the property is officially registered, and the title deed confirms your freehold ownership.

- Pre-Titles for Off-Plan Units: During construction, pre-title documents (Oqood) serve as legal proof of ownership. This guarantees your investment stake until handover.

- Legal Protection: All transactions are regulated, ensuring buyer rights are upheld under UAE law.

Final Thoughts

Investing in Al Marjan Island properties offers a rare combination of security, high returns, and long-term growth. With freehold ownership, strict escrow regulations, flexible payment plans, clear closing costs, and access to UAE residency visas, this is one of the most exciting real estate opportunities in the region.

While many of these regulatory protections apply across the UAE, Al Marjan Island stands out as a premium waterfront destination with a strategic location just 45 minutes from Dubai, a booming tourism sector, and a master-planned infrastructure designed for long-term success.

Timing is everything. Secure your place in one of the UAE’s most promising real estate markets today.

Contact us to schedule your consultation.